Absa Bank Uganda has disbursed a UGX 19 billion loan facility to Mogo Loans in a partnership aimed at transforming Uganda’s informal economy by making electric bikes accessible to ‘boda boda’ operators.

At the heart of this initiative is Mogo Loans, which is committed to providing affordable financing options for boda boda operators to acquire electric bikes. The structured loan is set to be repaid over a maximum period of 30 months, empowering hundreds of riders to transition to environmentally-friendly electric bikes that are cheaper to maintain and operate.

David Wandera, the Executive Director & Head of Markets for Absa Bank Uganda, emphasized the broader implications of this partnership during the memorandum of understanding (MOU) signing ceremony.

He stated, “We are aware that a significant share of economic activity is within the informal sector; however, access to financial services remains the main obstacle for growth of informal businesses and could be a possible incentive for them to formalise.”

Wandera highlighted that this partnership goes beyond a typical loan transaction, aiming to drive greater financial inclusion while contributing to a green economy.

The significance of this initiative cannot be overstated, especially considering World Bank data indicating that nearly 72% of businesses and 78% of the labor force in Uganda are part of the informal economy. With Uganda’s goal to reduce the size of the informal sector from 51% to 45% by 2025, partnerships like this one with Mogo Loans are crucial.

Mikhail Vydryn, CEO of Mogo Uganda, shared insights into their operations and ambitions: “Mogo Uganda has demonstrated significant investment in Uganda, with a net loan portfolio totaling 28 million EUR. Absa’s involvement through local currency funding mitigates Mogo Uganda’s FX risk.”

He further noted that since their launch in May, they have successfully financed nearly 870 electric boda units, enabling clients to travel over 2.5 million kilometers using clean electricity.

“This initiative has not only resulted in a significant reduction of approximately 70 tonnes of CO₂ emissions but has also created substantial economic benefits for the riders,” he added.

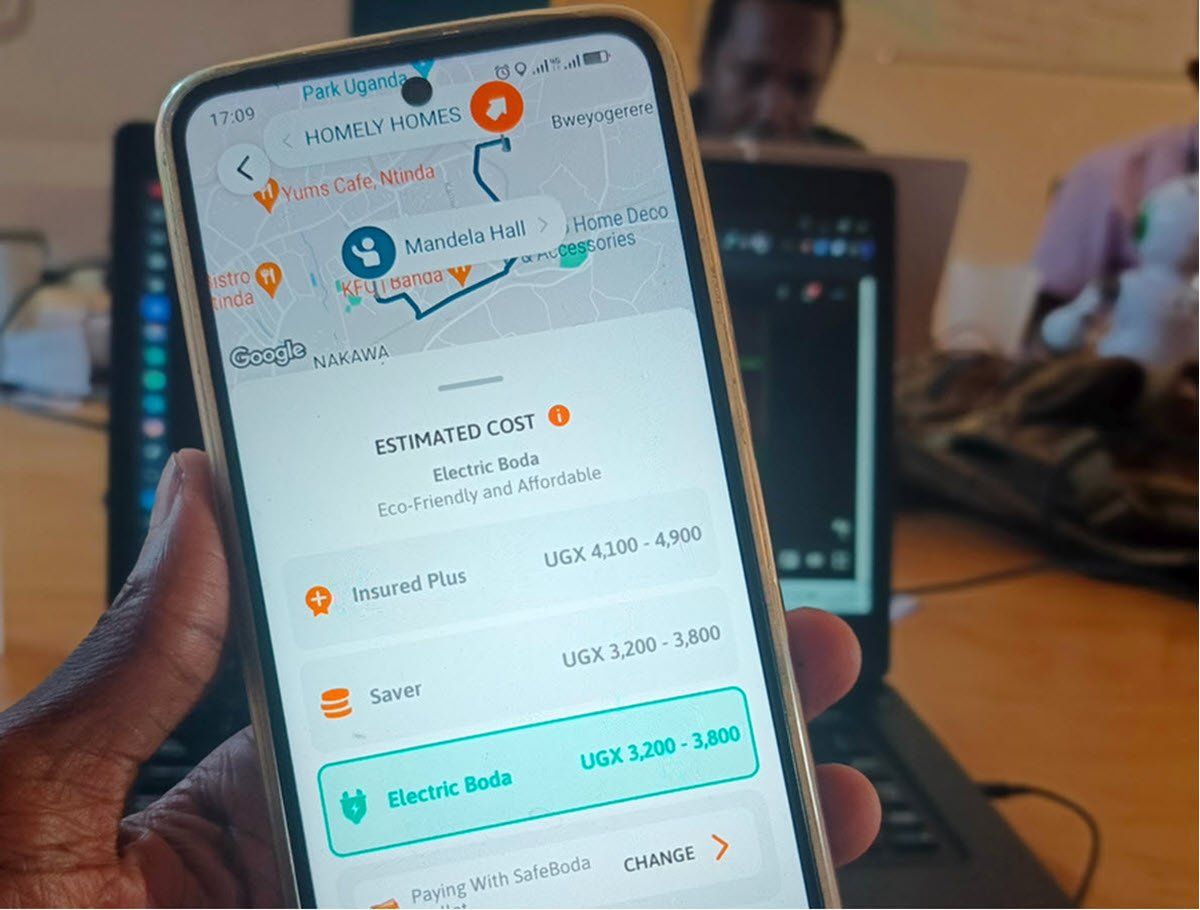

The electric bikes funded through this loan represent a revolutionary solution for Uganda’s boda boda industry. With zero emissions, they align perfectly with global trends towards greener transportation.

Riders can charge their bikes for just UGX 8,000 for 80 kilometers—far more efficient than fossil fuel bikes that cost UGX 10,000 for only 70 kilometers. This shift not only promises environmental benefits but also substantial cost savings for riders.

The agreement was executed in September 2024, with an initial tranche of UGX 5 billion disbursed. The phased release will continue as needed by Mogo Loans for on-lending purposes, ensuring flexibility throughout the deal lifecycle.

Wandera remarked on the complexity involved in securing this landmark agreement: “Despite the lack of tangible security, Absa Bank Uganda confidently entered this partnership based on the strength of Mogo Loans’ corporate guarantees and the potential of the project.”

This partnership is more than just financial support; it reflects Absa Bank’s commitment to empowering communities and fostering sustainable growth. Wandera concluded by stating, “Every transaction we engage in is a testament to our commitment to empower, uplift, and transform the communities we serve.”

With projections indicating that Mogo Uganda will issue up to 1,000 electric motorbikes by the end of 2024, this collaboration stands as a beacon of hope for many informal operators who often struggle with upfront costs.