In a move that’s sending shockwaves through Kenya’s burgeoning tech landscape, the Communications Authority (CA) has proposed a dramatic increase in licensing fees for satellite internet service providers. This decision could reshape the country’s digital future and has major implications for global players like Starlink.

The CA’s proposal, unveiled in December, aims to overhaul the Satellite Landing Rights (SLR) license structure. The changes on the table are significant and far-reaching.

First, there’s a staggering tenfold increase in the initial license fee, jumping from a modest Ksh1.6 million ($12,302) to a whopping Ksh15 million ($115,331) for a 15-year license. This substantial hike is accompanied by the introduction of an annual operating fee set at Ksh4 million or 0.4% of the company’s annual gross turnover, whichever is higher.

To round out the new fee structure, the CA has also proposed a Ksh5,000 application fee for each license. These changes aren’t just about numbers on a page. They represent a seismic shift in Kenya’s approach to regulating the rapidly expanding satellite internet market.

Starlink in the crosshairs

Elon Musk’s Starlink, which has been making waves since its Kenyan debut in July 2023, finds itself at the center of this regulatory storm. In just 18 months, Starlink has skyrocketed to become Kenya’s tenth-largest internet service provider (ISP), boasting over 8,500 subscribers by the end of 2024.

This meteoric rise hasn’t gone unnoticed. Safaricom, Kenya’s telecom giant, voiced concerns about the potential threats posed by satellite internet providers back in June 2024. They urged the CA to mandate that satellite providers only operate through partnerships with existing local licensees.

The bigger picture

The CA’s move isn’t just about reining in Starlink. It’s part of a broader strategy to reshape Kenya’s telecommunications landscape. At its core, the new regulations aim to create a level playing field, allowing investors to land signals using any technology, embracing the principle of technology neutrality.

Furthermore, the CA is expanding the scope of what satellite providers can do. Under the new guidelines, these companies could soon be permitted to operate terrestrial cables, manage telemetry systems, and even engage in space research. This expansion of services could open up new avenues for innovation and competition in the sector.

Lastly, the CA wants satellite operators to establish a significant presence in Kenya, requiring them to operate in at least three counties. This move is likely aimed at ensuring that these global companies contribute more directly to local infrastructure and economic development.

Impact on the market, consumers

While the CA’s intentions may be to foster fair competition and generate revenue, the ripple effects could be far-reaching. One major concern is the potential for price hikes.

The increased operational costs might force providers like Starlink to raise their subscription rates, potentially putting their services out of reach for many Kenyans. This could slow down the expansion of high-speed internet access, particularly in underserved areas.

Another potential consequence is market consolidation. Smaller satellite ISPs, already serving less than 1,000 subscribers combined, may struggle to absorb these new fees. This could lead to a market dominated by a few large players, potentially reducing competition and innovation.

The CA’s challenge lies in striking the right balance between encouraging technological advancement and maintaining regulatory control. Too stringent measures could stifle innovation in the sector, while too lax an approach might leave the market vulnerable to monopolistic practices.

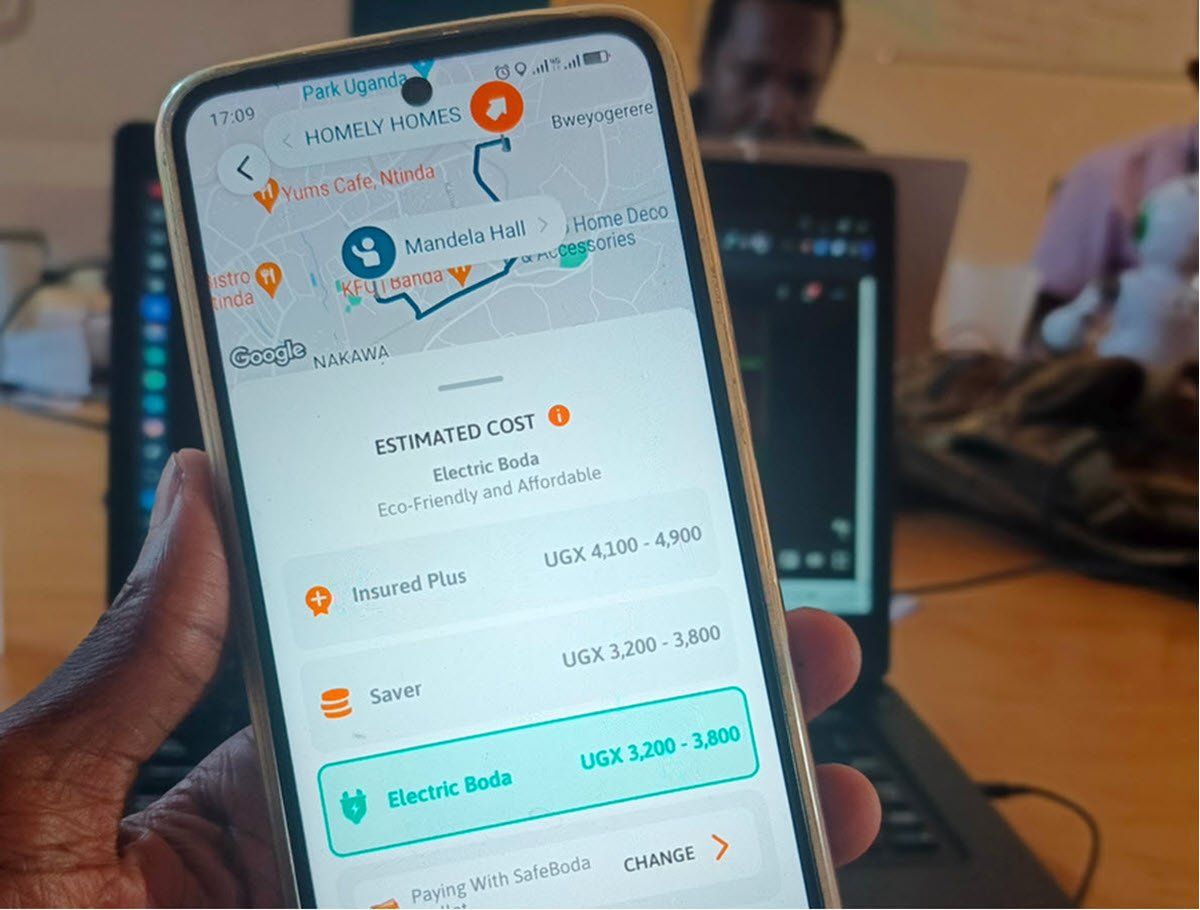

Read About: Here are the reasons for Starlink’s Uganda Launch Delay